42 coupon rate and ytm

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The yield to maturity defines the total return earn by the investor holding it until its maturity. 2: The rate of interest pays annually. The current Yield defines the rate of return it generates annually. 3: Interest rates influence the coupon rates: The current yield compares the coupon rate to the market price of the bond. 4 Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

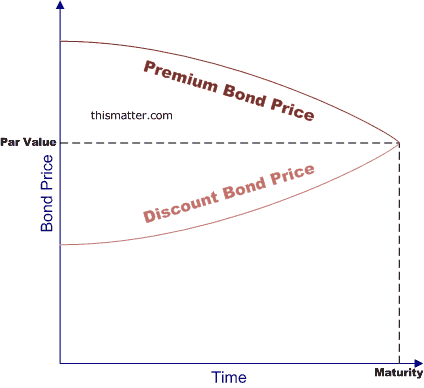

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula.

Coupon rate and ytm

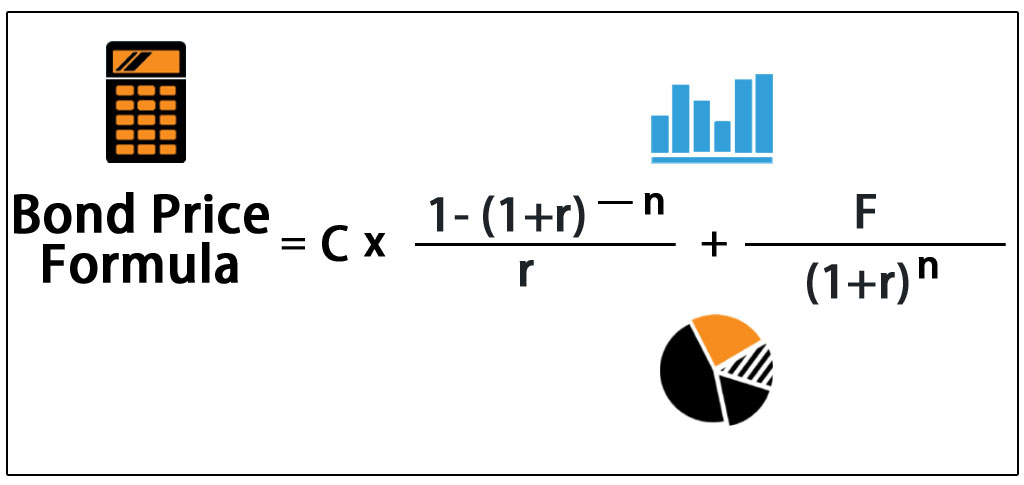

Yield to Maturity Calculator | Calculate YTM The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the principal; r - YTM ... Bond Yield to Maturity (YTM) Calculator - DQYDJ We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Coupon rate and ytm. money.stackexchange.com › questions › 74988Why bonds with lower coupon rates have higher interest rate risk? Jan 19, 2017 · @JoeTaxpayer I went to the investing answers Yield To Maturity calculator and tried some different inputs. For a $1000 face bond, paying 2% coupon paid quarterly, the price has to be $868 to get a 5.00% YTM. You are correct it isn't 60% off of face, so I will update the answer with better number – Par rate, coupon rate and YTM : CFA - reddit.com The par rate is: the COUPON RATE that makes that a bond will sell at par GIVEN interest rates (that is, given by the markt), or the YTM that makes that a bond will sell at par GIVEN coupon rate (that is, the coupon that decides the goverment). I know that it sound stupid and I'm 99,999% sure that the option correct is 1). I need confirmation. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity (YTM) - Meaning, Formula and Examples The coupon rate is more or less fixed. How do YTMs work? The price at which the bond can be bought from the market will tell you the present value of all the cash flows in the future. But, bonds are marketable securities, and the prices fluctuate with moving interest rates in the economy. Now, here's the catch.

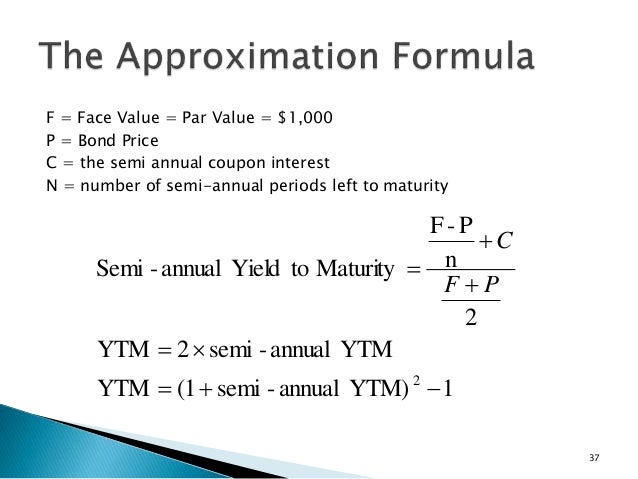

Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ... Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon RateA coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS. 1. Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%.

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...Face value: 10% Yield to Maturity (YTM) - Definition, Formula, Calculations Step by Step Calculation of Yield to Maturity (YTM) The steps to calculate Yield to Maturity are as follows. Gathered the information on the bond-like its face value, months remaining to mature, the current market price of the bond, the coupon rate of the bond. What is the Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation.

Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

Yield to Maturity (YTM) - Meaning, Formula & Calculation Since the bond is selling at a discount, the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 40/(1+YTM)^3+ 1000/(1+YTM)^3. We can try out the interest rate of 5% and 6%.

When is a bond's coupon rate and yield to maturity the same? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule.

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Answered: Today, a bond has a coupon rate of… | bartleby Today, a bond has a coupon rate of 12.1%, par value of $1,000, YTM of 8.20%, and semi-annual coupons with the next coupon due in 6 months. One year ago, the bond's price was $1,281.05 and the bond had 5 years until maturity.

› terms › cCoupon Rate Definition Sep 05, 2021 · This is the effective return called yield to maturity (YTM). For example, a bond with a par value of $100 but traded at $90 gives the buyer a yield to maturity higher than the coupon rate.

Coupon Rate - Meaning, Calculation and Importance The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer.

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

Clear and concise explanation of coupon rate and yield to maturity (YTM). This blog simplifies complex financial concepts, making it easier for readers to understand these important aspects of investing. A helpful resource for both beginners and experienced investors.

ReplyDeletepos canada

Portland Cab is a prominent and dependable taxi service that plays a pivotal role in the transportation landscape of Portland. With a steadfast commitment to efficiency, convenience, and customer satisfaction, Portland Cab has positioned itself as a preferred choice for both residents and visitors of the city.

ReplyDeleteThe menu at Silver Spoon Milton boasts a diverse array of dishes, ranging from traditional to contemporary. Whether it's succulent kebabs, flavorful biryanis, or rich curries, each dish is crafted with care to offer a harmonious blend of taste and authenticity. The chefs at Silver Spoon skillfully infuse every plate with the essence of halal ingredients, resulting in a dining experience that captivates the senses.

ReplyDelete