44 zero coupon bonds duration

Bonds & Rates - WSJ Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond . Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

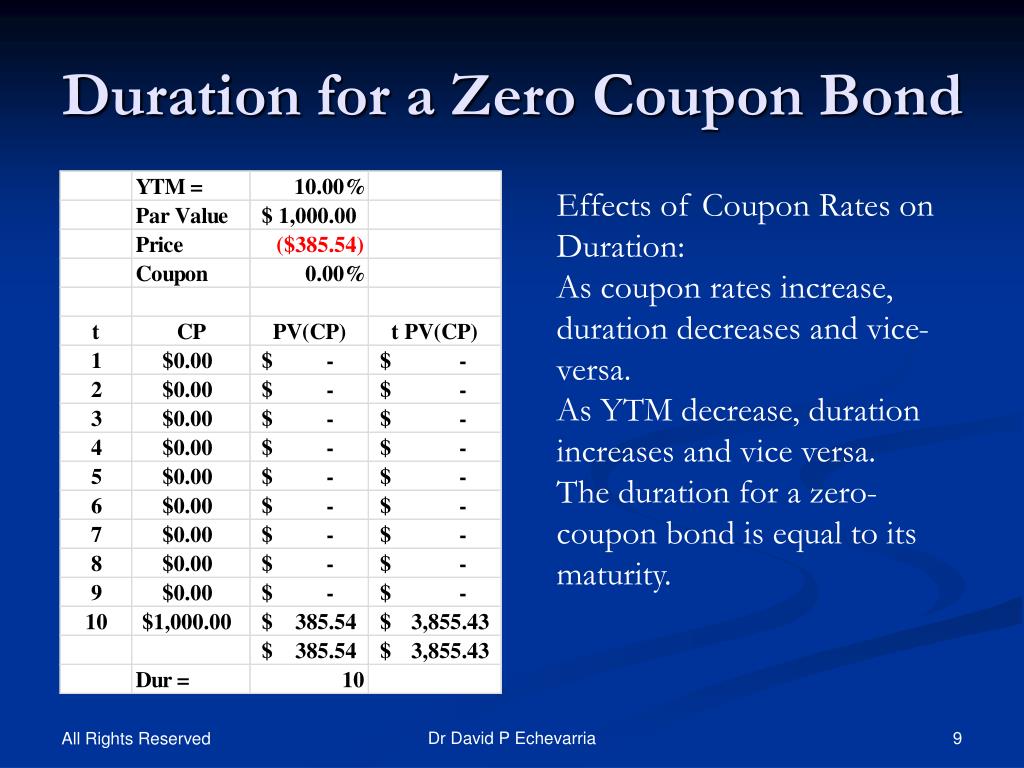

Bond Duration | Formula | Excel | Example - XPLAIND.com Example. On 14 November 2017, you added the three bonds to your company's investment portfolios: (a) a $1,000 zero-coupon bond yielding 5.1% to maturity which is 31 December 2020, (b) a $100 face-value 6% semi-annual bond maturing on 30 June 2023 and yielding 4.8% and (c) a $1,000 face value 5.5% semi-annual bond maturing on 30 June 2023 and ...

Zero coupon bonds duration

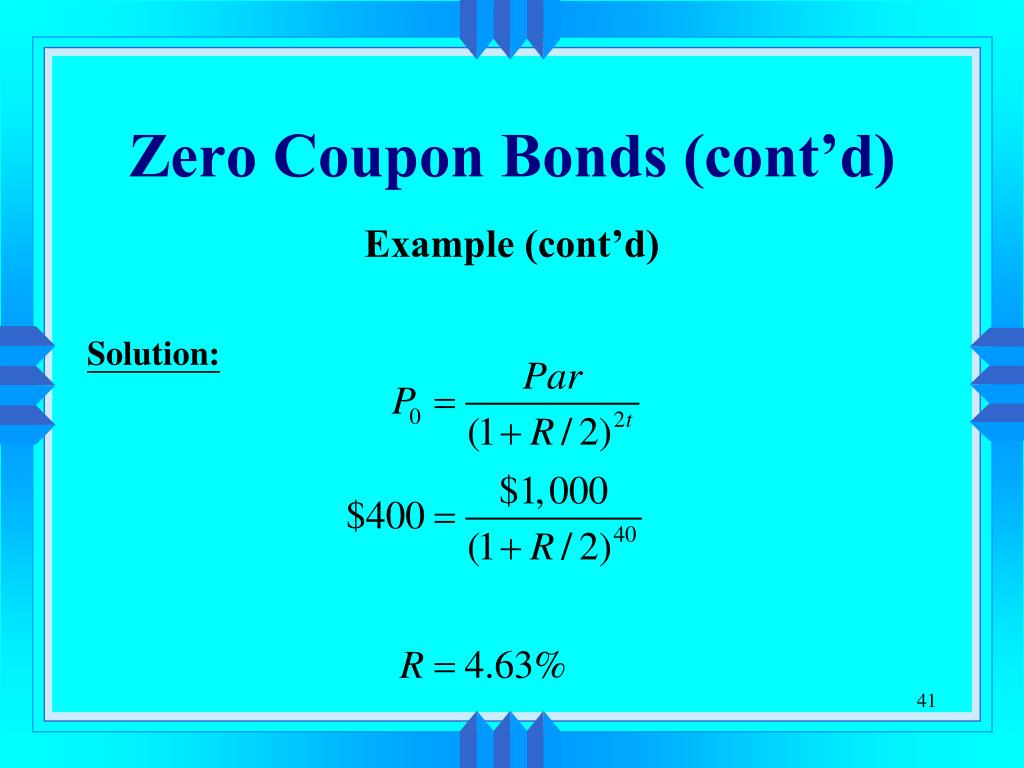

ZROZ ETF Report: Ratings, Analysis, Quotes, Holdings | ETF.com Since STRIPs are zero coupon bonds, they are particularly sensitive to interest-rate risk. As a result, the fund's effective duration is much higher, which in turn produces volatile results ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding PDF Duration - New York University Duration 7 For zero-coupon bonds, there is an explicit formula relating the zero price to the zero rate. We use this price-rate formula to get a formula for dollar duration. Of course, with a zero, the ability to approximate price change is not so important, because it's easy to do the exact calculation.

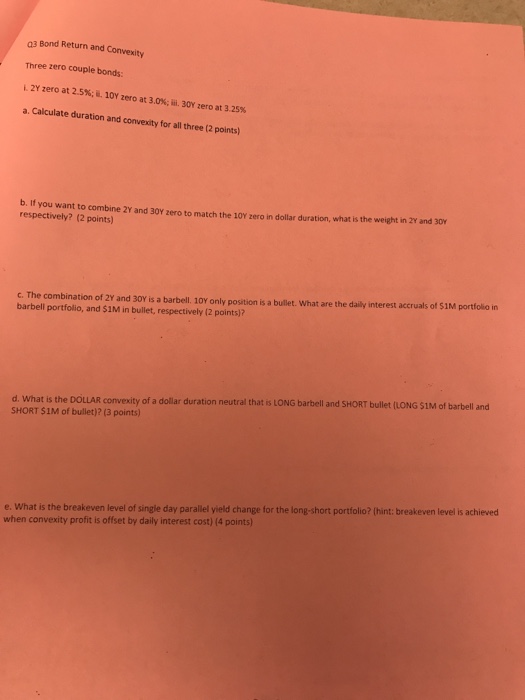

Zero coupon bonds duration. The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and... Convexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield. The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. groww.in › p › zero-coupon-bondZero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... Dollar Duration - Overview, Bond Risks, and Formulas The formula for calculating dollar duration is: Dollar Duration = DUR x (∆ i/1+ i) x P Alternatively, if the change in the value of the bond and the yield is known, another formula can be used: DV01 = - (ΔBV/10000 * Δy) Where: ΔBV = Change in the value of a bond Δy = Change in yield Factor of Inaccuracy in Dollar Duration Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

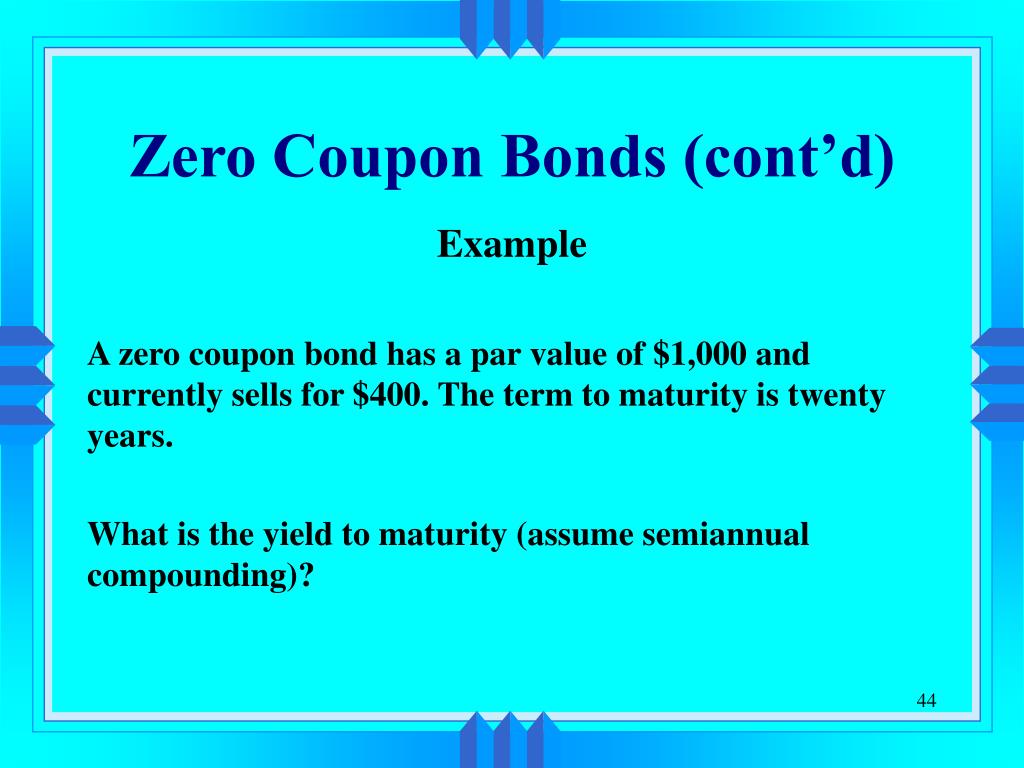

Duration Definition - Investopedia 11.11.2021 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is … Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

Duration and Convexity, with Illustrations and Formulas Among bonds with the same YTM and term length, lower coupon bonds have a higher convexity, with zero-coupon bonds having the highest convexity. This results because lower coupons or no coupons have the highest interest rate volatility , so modified duration requires a larger convexity adjustment to reflect the higher change in price for a given change in interest …

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond.

› dictionary › dWhat Is Duration of a Bond? - TheStreet Definition - TheStreet Mar 22, 2022 · Zero-Coupon Bonds. The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity.

Convexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

Zero-coupon bond - Wikipedia Zero coupon bonds may be long or short-term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value.

What Is Duration of a Bond? - TheStreet Definition - TheStreet 22.03.2022 · Zero-Coupon Bonds. The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does …

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … If rates fall longer duration zero-coupon bonds will increase in value significantly more than shorter duration federal government bonds & federal bonds which pay a regular coupon. If rates rise the converse is true - zero-coupon bonds will be hit much harder than other bonds. Negative Yields . After the financial crisis of 2008-2009 central banks became far more …

› terms › dDuration Definition - Investopedia Nov 11, 2021 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

How to Invest in Zero-Coupon Bonds | Bonds | US News While that's not terrible compared to many safe interest earning funds, it's probably not enough to compensate for the high risk. The fund has a "duration" of about 27 years, meaning it could lose...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!) Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the ...

Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Post a Comment for "44 zero coupon bonds duration"