38 coupon rate of bond

Ομόλογο - Βικιπαίδεια Επιτόκιο Έκδοσης (coupon rate): Υπάρχουν ομόλογα σταθερού επιτοκίου (fixed rate bond), δηλαδή ομόλογα που πληρώνουν το ίδιο τοκομερίδιο σε όλη την διαρκή της ζωής τους, και ομόλογα μεταβλητού ή ... What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Coupon rate of bond

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer promises to make periodic payments to the bondholder, based on the principal amount of the bond, ... Coupon Rate Structure of Bonds — Valuation Academy A Coupon is the payment that the bond issuer pays the bond holder at certain frequency. Normally the coupon is paid semi-annually or annually. Some of the most common types of Bonds based on their coupon rate structures are: 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face ...

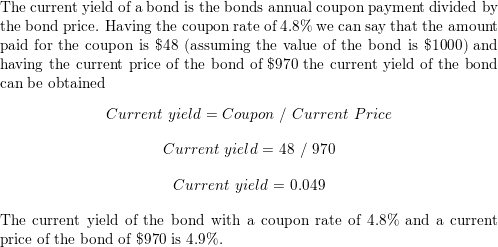

Coupon rate of bond. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. What is a Bond Coupon Rate? - Financial Expert™ The coupon rate of a bond is the rate of interest that a borrower will pay on the original amount they borrowed. The coupon rate is usually stated in the name of the bond. To illustrate this: GLAXOSMITHKLINE CAPITAL PLC 5.25% NT REDEEM has a coupon rate of 5.25%. Said another way, the coupon rate is the relationship between. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Understanding Coupon Rate and Yield to Maturity of Bonds The Coupon Rate is the amount that you, as an investor, can expect as income as you hold the bond. The Coupon Rate for each bond is fixed upon issuance. Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. nerdcounter.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years’ maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Coupon Bond - Guide, Examples, How Coupon Bonds Work What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

Bond Coupon Rate Definition | Law Insider Related to Bond Coupon Rate. Coupon Rate has the meaning set forth in Section 2.8.. Bond Rate means, with respect to any Series or Class, the rate at which interest accrues on the principal balance of Transition Bonds of such Series or Class, as specified in the Series Supplement therefor.. Weekly Rate means an interest rate on the Bonds set under Section 2.02(a)(2).

Coupon Bond | Definition | Rates | Benefits & Risks | How It Works Coupon Bond Definition. A coupon bond is an investment that pays a regular interest payment to the holder of the security. The issuer guarantees that it will pay this amount as long as they hold on to the coupon bond. The issuer is also obligated to repay the whole of the bond's face value on its maturity date.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA These bonds come with a par value and a coupon rate, which is the bond's yield at the time of issuance. Bonds with higher coupon rates provide investors a higher investment yield. A CB is also known as a bearer bond. All in One Financial Analyst Bundle (250+ Courses, 40+ Projects)

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

1. the Coupon Rate of a Bond Equals - Docest A) The coupon rate increases to 10%. B) The coupon rate remains at 9%. C) The coupon rate remains at 8%. D) The coupon rate decreases to 8%. Answer: C. 10. When the yield curve is upward-sloping, then: A) short-maturity bonds offer high coupon rates. B) long-maturity bonds are priced above par value.

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more " refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond matures. read more. In other words, it is the stated rate of interest paid on fixed-income securities, primarily ...

What Are Floating Rate Bonds? | News and Insights | IndiaBonds A bond of XYZ Ltd. (corporate bond) is issued at: Coupon/interest rate - 7% Benchmark - (Repo rate) - 5% Mark-up - 200bps or 2% over the benchmark rate Rate adjustment period - 6 months Thus, a floating rate bond will have an interest/coupon rate of 5.00% + 2.00% = 7.00%. After 6 months, if the repo rate rises up to 5.50%

What is 'Coupon Rate' - The Economic Times What is 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Χ.Α + Markets (241): Πολλά μικρά και μεγάλα ενδιαφέροντα (24/10) 24. Okt. 2022 · The bond has a 3-year maturity and is callable in year 2 with a coupon of 7.00% and a yield of 7.25%. The issuance was covered by institutional investors (55%), wealth management (20%), supranational organisations (13%) and asset managers (12%). Following the transaction, MREL pro-forma ratio stands at 19.5% as of 2Q22. The news is neutral and …

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Bond Coupon Rate? Coupon rate, also known as the nominal rate, nominal yield or coupon payment, is a percentage that describes how much is paid by a fixed-income security to the owner of that security during the duration of that bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Coupon Rate Structure of Bonds — Valuation Academy A Coupon is the payment that the bond issuer pays the bond holder at certain frequency. Normally the coupon is paid semi-annually or annually. Some of the most common types of Bonds based on their coupon rate structures are: 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer promises to make periodic payments to the bondholder, based on the principal amount of the bond, ...

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage...

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 coupon rate of bond"