39 what is the duration of a zero coupon bond

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Modified Duration Formula | Bionic Turtle Zero-coupon bonds are popular (in exams) due to their computational convenience. We barely need a calculator to find the modified duration of this 3-year, zero- ...

Duration of a zero coupon bond with 7 years to maturity a yield to ... 16. Duration of a zero coupon bond with 7 years to maturity, a yield to maturity of 5%, and a face value of is $100 is ____ A. More than 7 years B. Exactly 7 years C. Less than 7 years D. It depends on the yield curve at that point in time. 17.

What is the duration of a zero coupon bond

Zero Coupon Bond -Features, benefits, drawbacks, taxability ... - Fisdom Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero coupon bonds are issued periodically by governments and pseudo-government institutions. Once these bonds are issued, they can be bought through stock exchanges such as NSE and BSE. Duration Definition and Its Use in Fixed Income Investing Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

What is the duration of a zero coupon bond. Zero-Coupon Bond - Wall Street Prep In our illustrative scenario, let's say that you're considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions Face Value (FV) = $1,000 Number of Years to Maturity = 10 Years Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0% How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity... Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would...

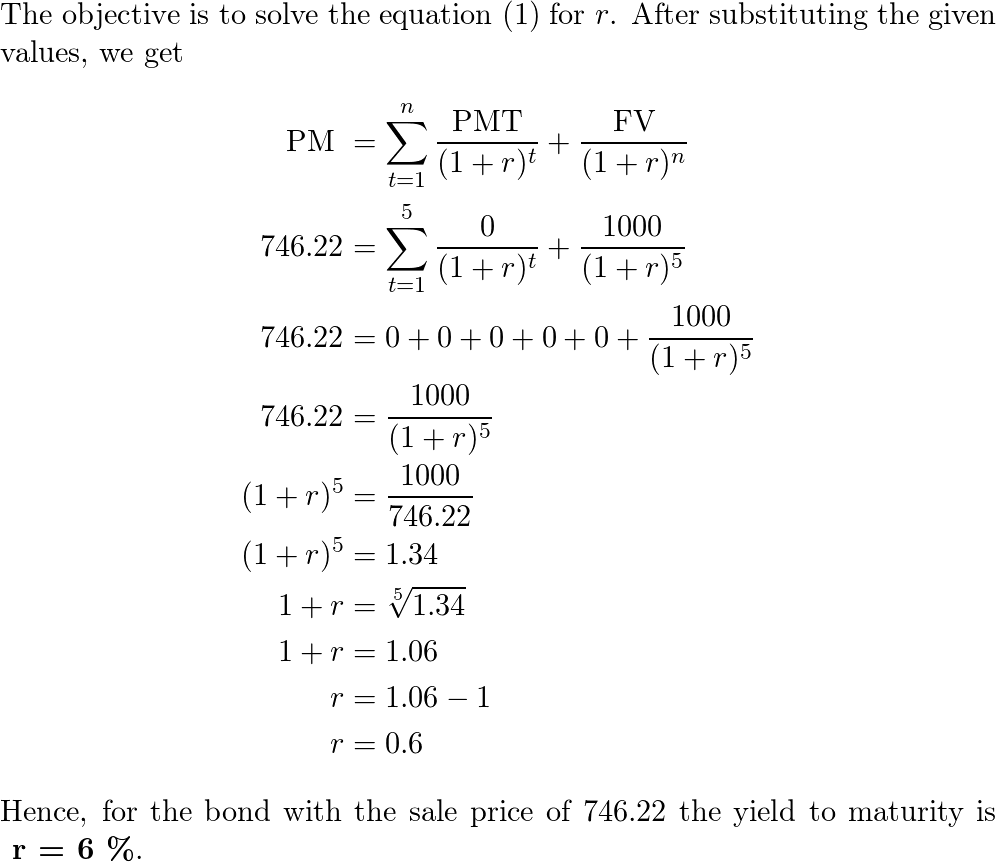

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Zero Coupon Bond Funds: What Are They? - thebalancemoney.com A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds. What is the period of a zero coupon bond? | Personal Accounting Zero coupon bonds have a period equal to the bond's time to maturity, which makes them sensitive to any modifications within the rates of interest. Investment banks or dealers might separate coupons from the principal of coupon bonds, which is known as the residue, so that different buyers might obtain the principal and each of the coupon ... Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Therefore, the Zero Coupon bonds generally come with a time horizon of 10 to 15 years. On the other hand, these bonds with a time period of less than one can be a short-term investment option. Who Should Consider Zero-Coupon Bonds For Investing?

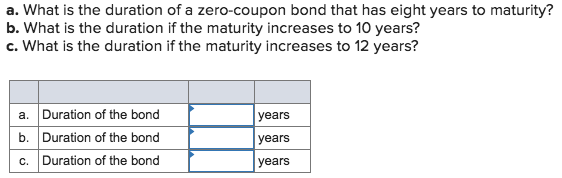

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. 4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ... What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Solved 37. What is the duration of a zero-coupon bond that | Chegg.com 100% (1 rating) Zero coupon bond are not eligible for duration calculation as …. View the full answer. Transcribed image text: 37. What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years?

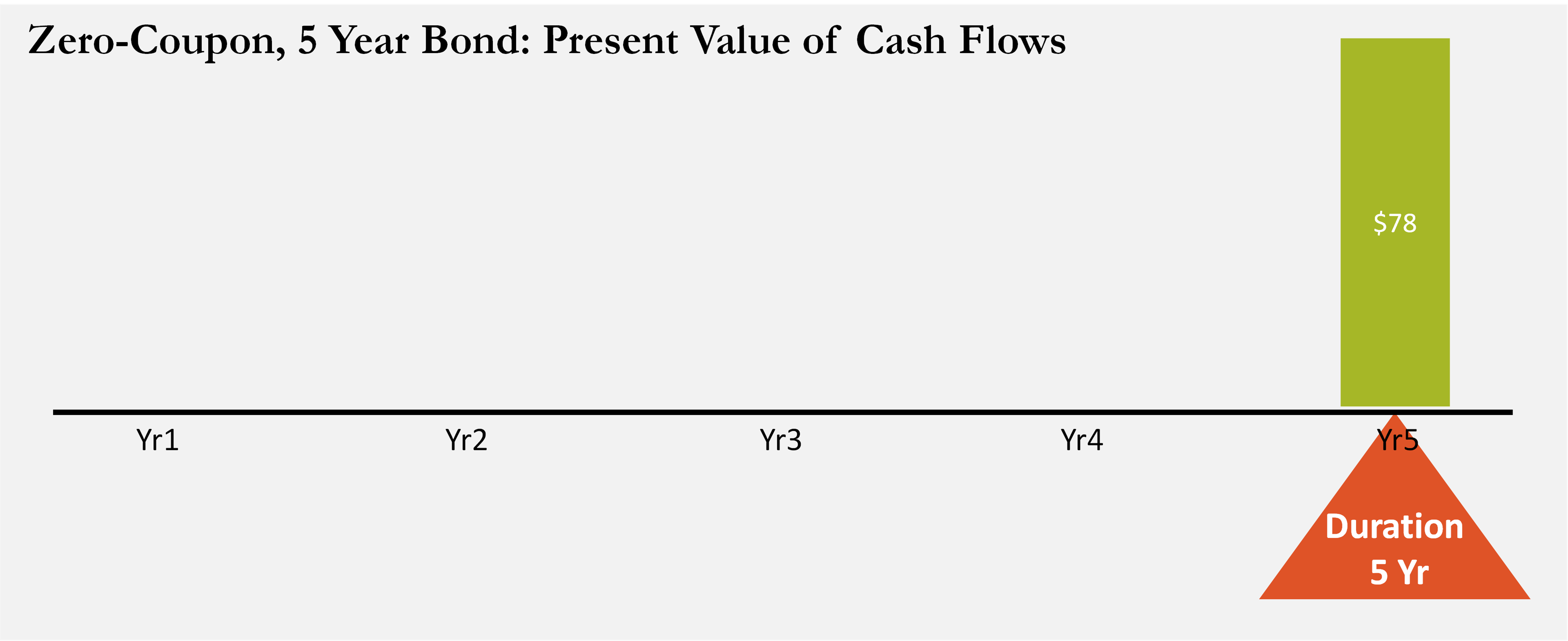

PDF Understanding Duration - BlackRock • Because zero coupon bonds make no coupon payments, a zero coupon bond's duration will be equal to its maturity. • The longer a bond's maturity, the longer its duration, because it takes more time to receive full payment. The shorter a bond's maturity, the shorter its duration, because it takes less time to receive full payment. Term

The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

What is the duration of a zero-coupon bond that has eight years ... - Quora The duration of a zero-coupon bond is by definition equal to its maturity, so an 8-year zero has a duration of 8 years. If the maturity increases to 10 years, then so does the duration. 1 Kyle Taylor Founder at The Penny Hoarder (2010-present) Updated Wed Promoted Should you leave more than $1,000 in a checking account? You've done it.

Zero Coupon Bond Calculator - Nerd Counter Both of these words represent the common zero coupon bond term. Zero Coupon bond is also named as accrual bond and it lacks the coupons or the installments procedure for making the payments; instead, a single payment at the level of maturity (the time period or the duration) is paid.

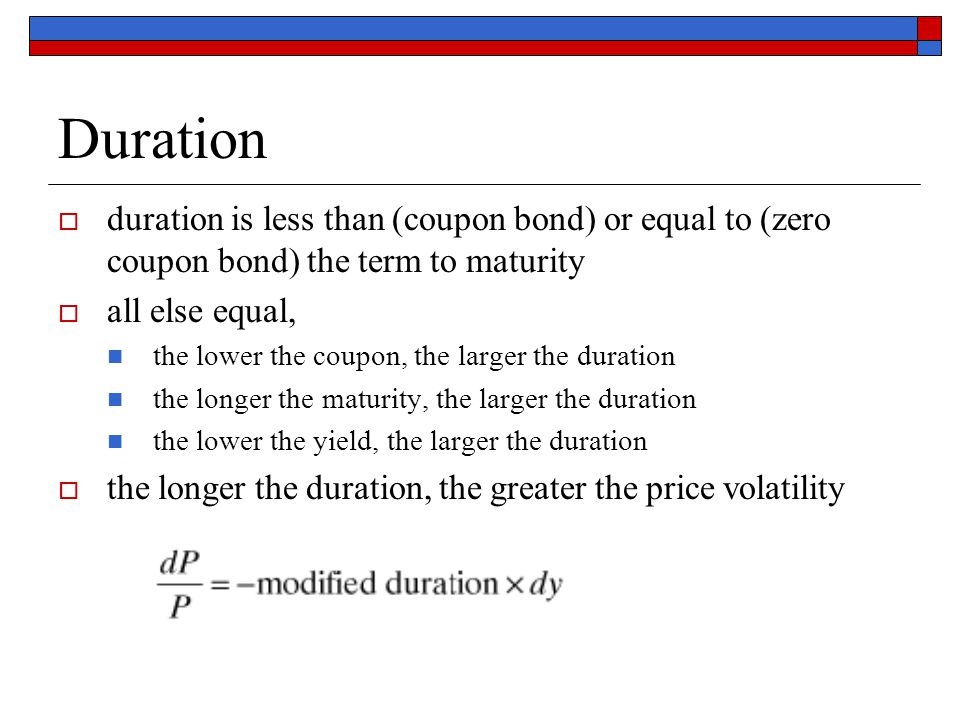

Bond duration: how it works and how you can use it - Monevator Oct 25, 2022 · What is bond duration? Bond duration expresses a bond’s vulnerability to interest rate risk. The larger the bond duration number, the more reactive a bond’s price is to interest rate changes, as the bond’s yield adjusts to reflect those changes. For example, if a bond’s duration number is 11, then it:

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Understanding bond duration - Education | BlackRock Conversely, if a bond has a duration of five years and interest rates fall by 1%, the bond's price will increase by approximately 5%. Understanding duration is particularly important for those who are planning on selling their bonds prior to maturity. If you purchase a 10-year bond that yields 4% for $1,000, you will still receive $40 dollars ...

Zero-coupon bond - Wikipedia A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years. For some Canadian bonds, the maturity may be over 90 years. [citation needed]

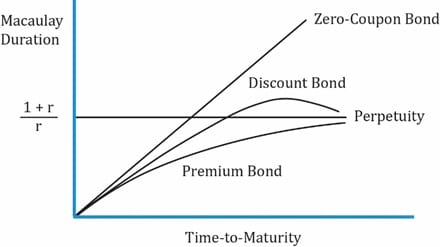

What is the relation between the coupon rate on a bond and its duration ... The duration of a zero-coupon bond equals time to maturity. Holding maturity constant, a bond's duration is lower when the coupon rate is higher, because of the impact of early higher coupon payments. Holding the coupon rate constant, a bond's duration generally increases with time to maturity. How is YTM related to time?

Zero Coupon Bond Calculator – What is the Market Price ... Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!)

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

What Is a Zero-Coupon Bond? - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

Duration: Understanding the relationship between bond prices ... Duration is expressed in terms of years, but it is not the same thing as a bond's maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration.

For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

Duration Definition and Its Use in Fixed Income Investing Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

Zero Coupon Bond -Features, benefits, drawbacks, taxability ... - Fisdom Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero coupon bonds are issued periodically by governments and pseudo-government institutions. Once these bonds are issued, they can be bought through stock exchanges such as NSE and BSE.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 what is the duration of a zero coupon bond"