40 what is bond coupon rate

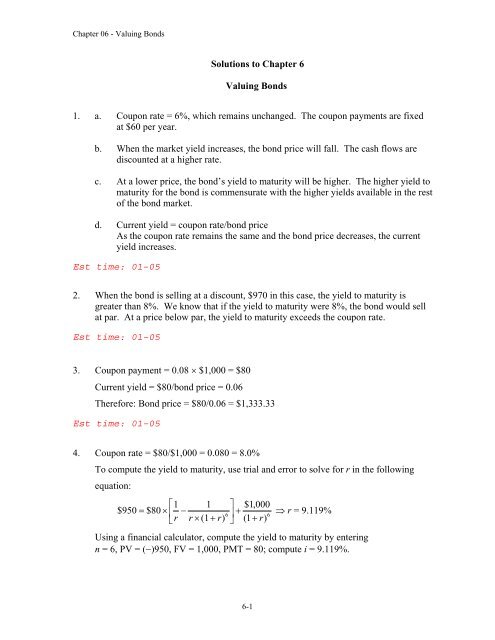

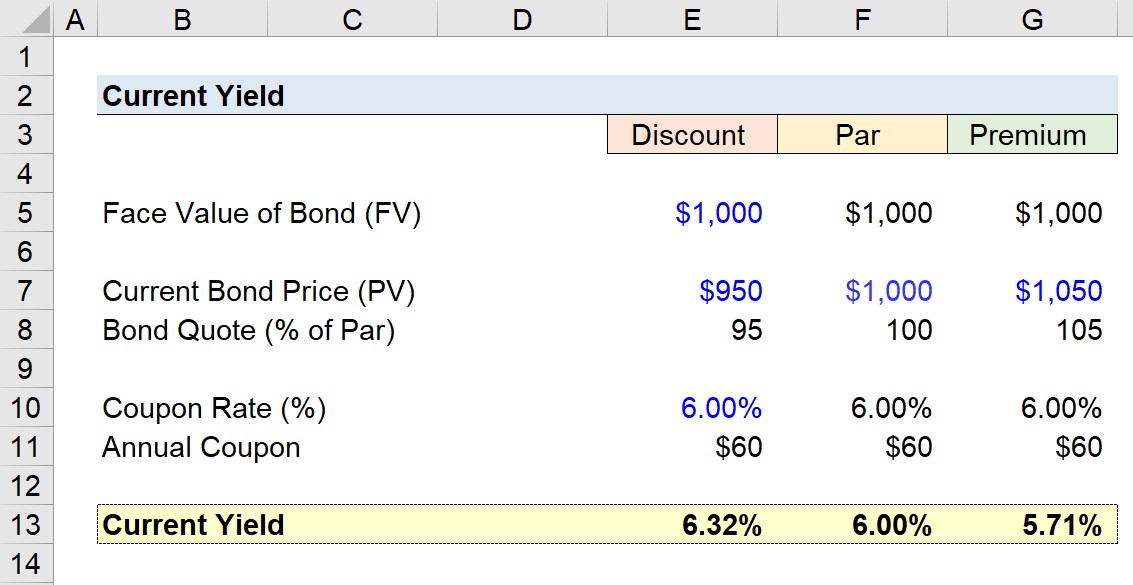

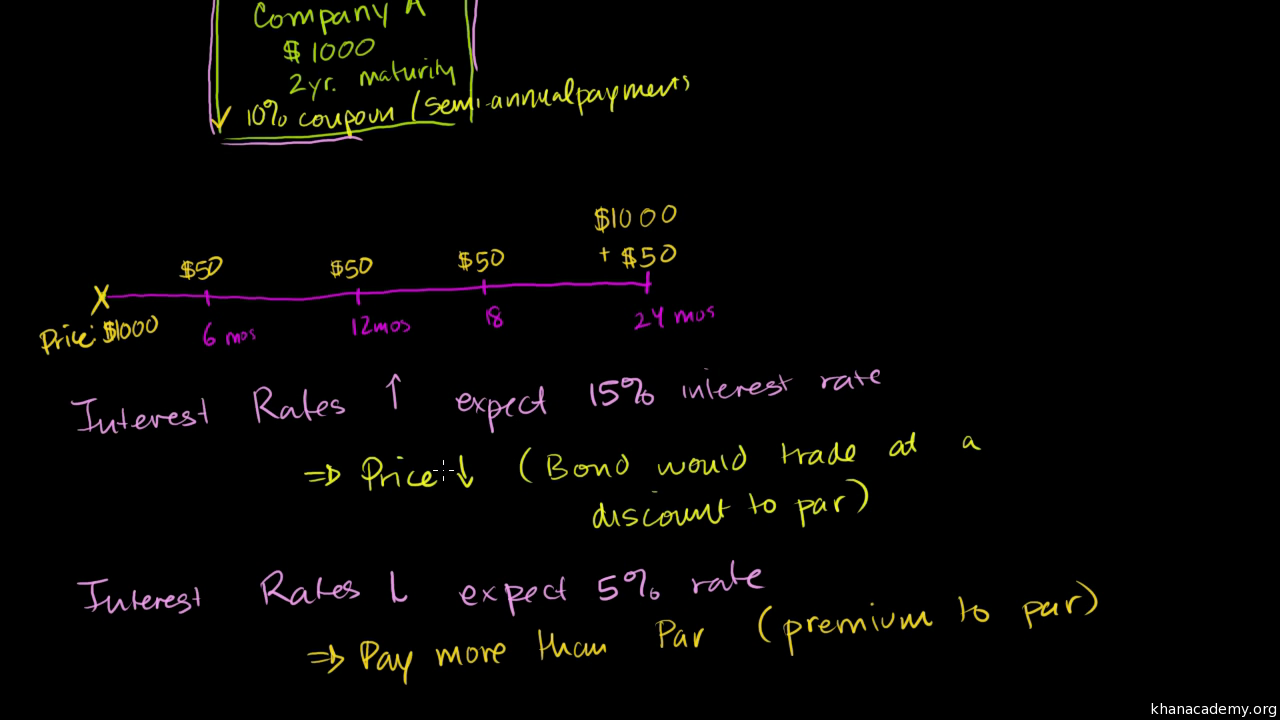

What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to... What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Bond Coupon Rate? Coupon rate, also known as the nominal rate, nominal yield or coupon payment, is a percentage that describes how much is paid by a fixed-income security to the owner of that security during the duration of that bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

What is bond coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond,... What is the after.docx - 1. What is the after-tax return on... What is the after-tax return on an 8% coupon rate bond for an investor in a 25% marginal tax bracket? CORRECT ANSWER: 6% see more. CORRECT ANSWER : 6 % see more. 2. A steeply upward-sloping yield curve indicates that: CORRECT ANSWER: Interest rates are expected to rise in the future.

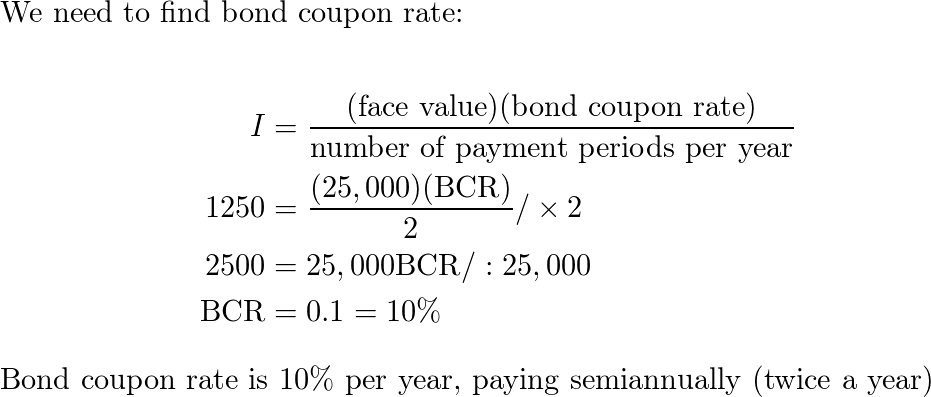

What is bond coupon rate. Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. Best Fixed Deposit Rates yield 3.9% - Better than Singapore Savings ... Back in September, I wrote a post rounding up the best Fixed Deposit Rates in Singapore. Back then, the best Fixed Deposit accounts yielded 2.85% (I know…). What a difference 2 months makes! Fast forward to November - and the best Fixed Deposit pays 3.9% these days. With the latest T-Bills yielding 4.0% and only […] [Solved] A bond that matures in 10 years has a 1000 par value The ... A bond that matures in 10 years has a $1,000 par value. The annual coupon interest rate is 11 percent and the market's required yield to maturity on a comparable-risk bond is18 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link.

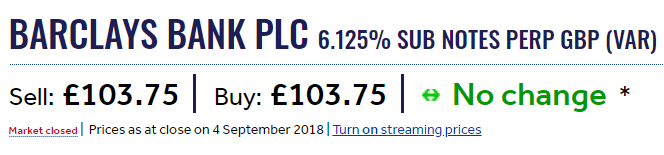

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. What is a Bond Coupon Rate? - Financial Expert™ The coupon rate of a bond is the rate of interest that a borrower will pay on the original amount they borrowed. The coupon rate is usually stated in the name of the bond. To illustrate this: GLAXOSMITHKLINE CAPITAL PLC 5.25% NT REDEEM has a coupon rate of 5.25%. Said another way, the coupon rate is the relationship between Answered: 3. What is the semi-annual coupon rate… | bartleby Q: Suppose a seven-year, $1,000 bond with an 8.1% coupon rate and semiannual coupons is trading with a… A: a) Yield to maturity (YTM) of the bond is the rate which investors will earn if the bond is held… What is a Coupon Rate? - Definition | Meaning | Example For example, the rate of a government bond is usually paid once a year, but if it is a U.S. bond the payment is made twice a year. Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum.

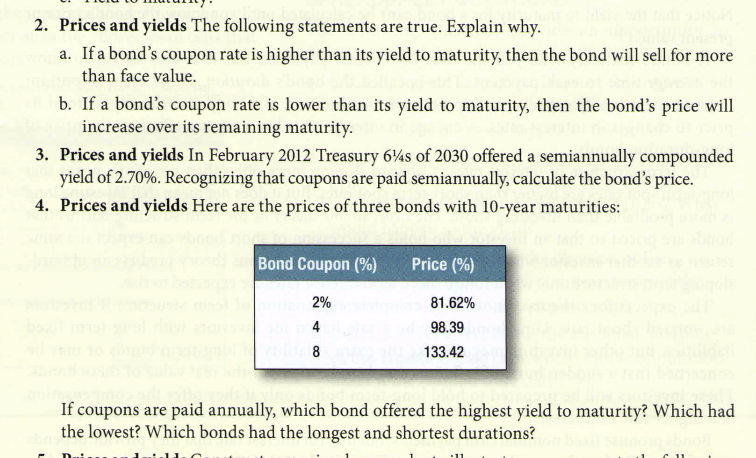

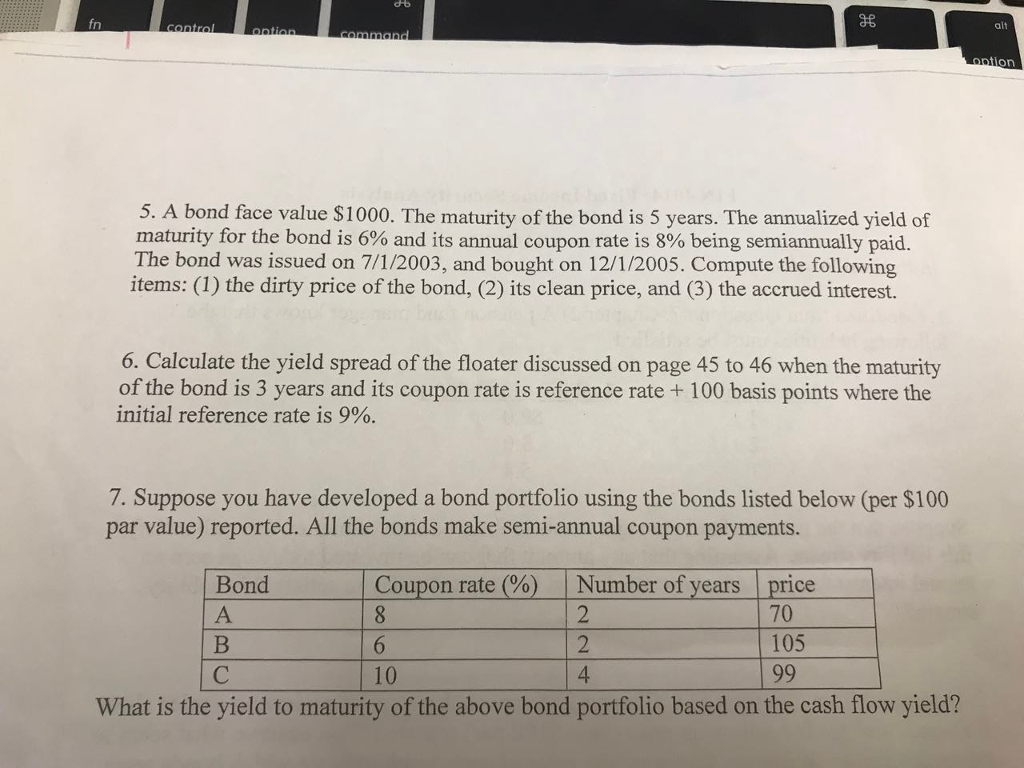

Coupon Bond - Guide, Examples, How Coupon Bonds Work What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Bond: Definition, How They Work, Example, and Use Today The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a...

Rising interest rates to mute bond issuance this fiscal: Report Mumbai: Corporate bond issuance is likely to remain muted witnessing 4-5 per cent growth this fiscal to touch Rs 41.42 lakh crore on rising coupon rates, despite the drawdown more than doubling in the second quarter, a report said. Bond sales more than doubled to Rs 2.1 lakh crore in the second quarter from the first quarter, when it was at a ...

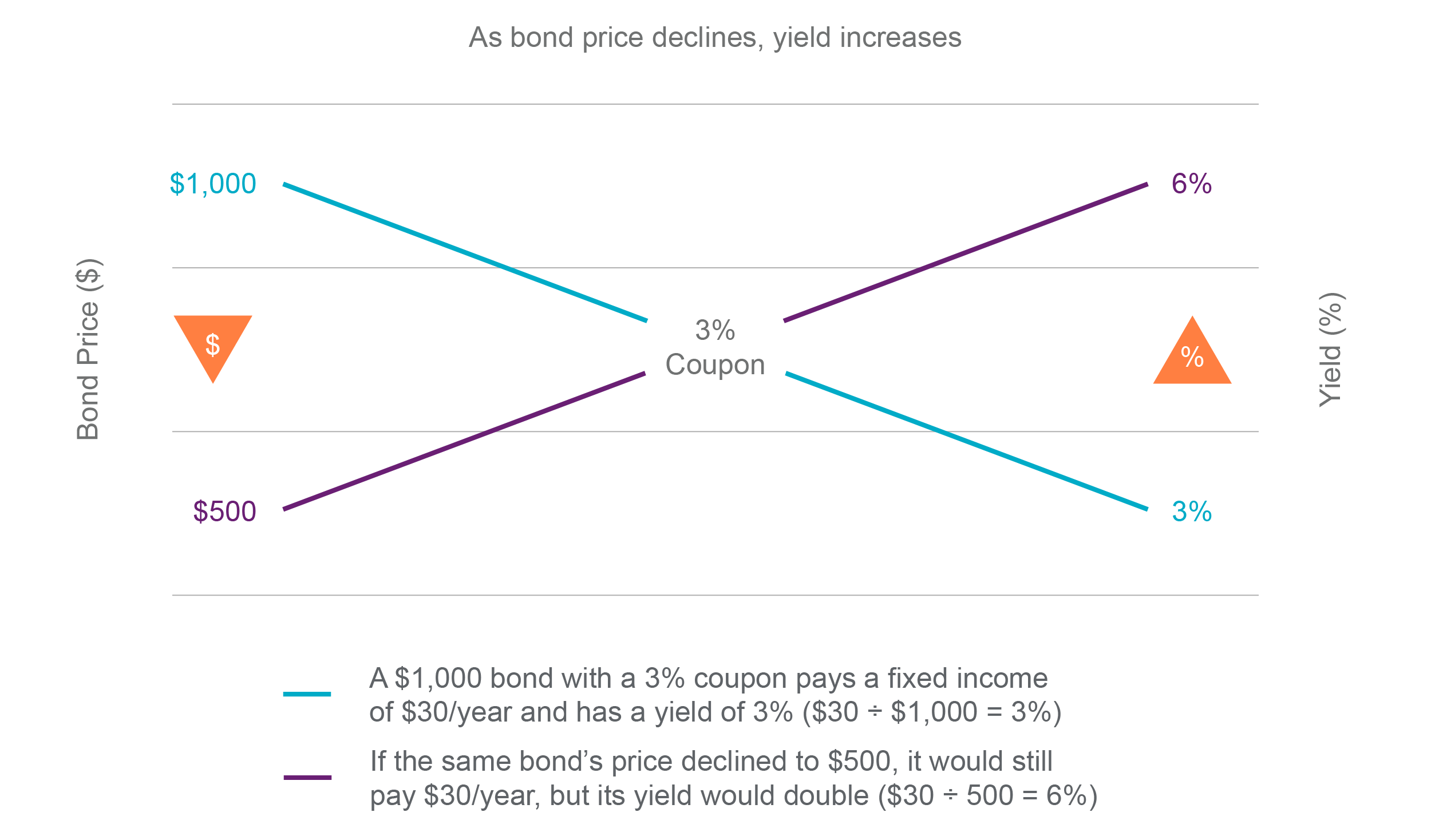

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

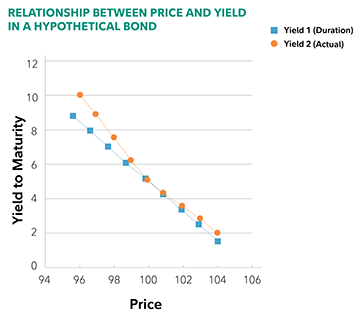

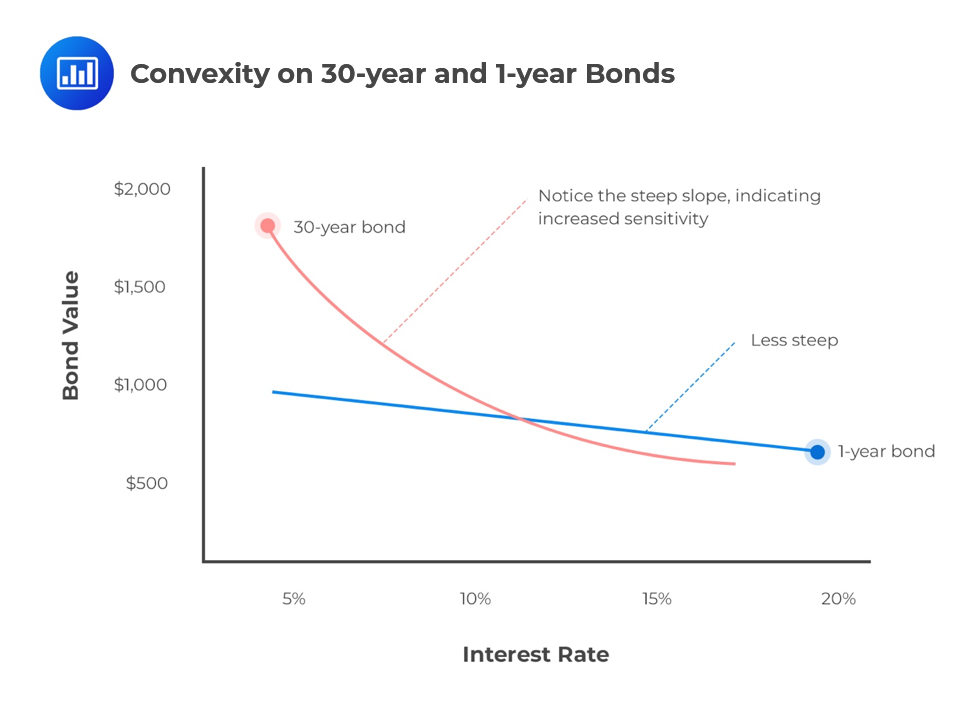

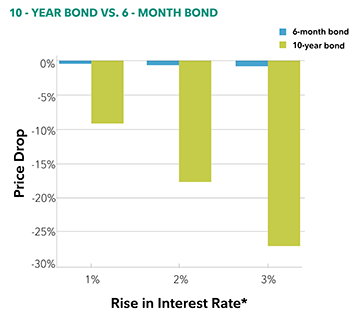

What is the relation between the coupon rate on a bond and its duration ... Bonds with low coupon rates will have higher interest rate risk than bonds that have higher coupon rates. For example, consider a bond with a coupon rate of 2% and another bond with a coupon rate of 4%. Which is an example of a fixed coupon rate? Coupon rates are fixed, but yields are not. Another example would be that a $1,000 face value bond ...

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Relevance and Uses. Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ...

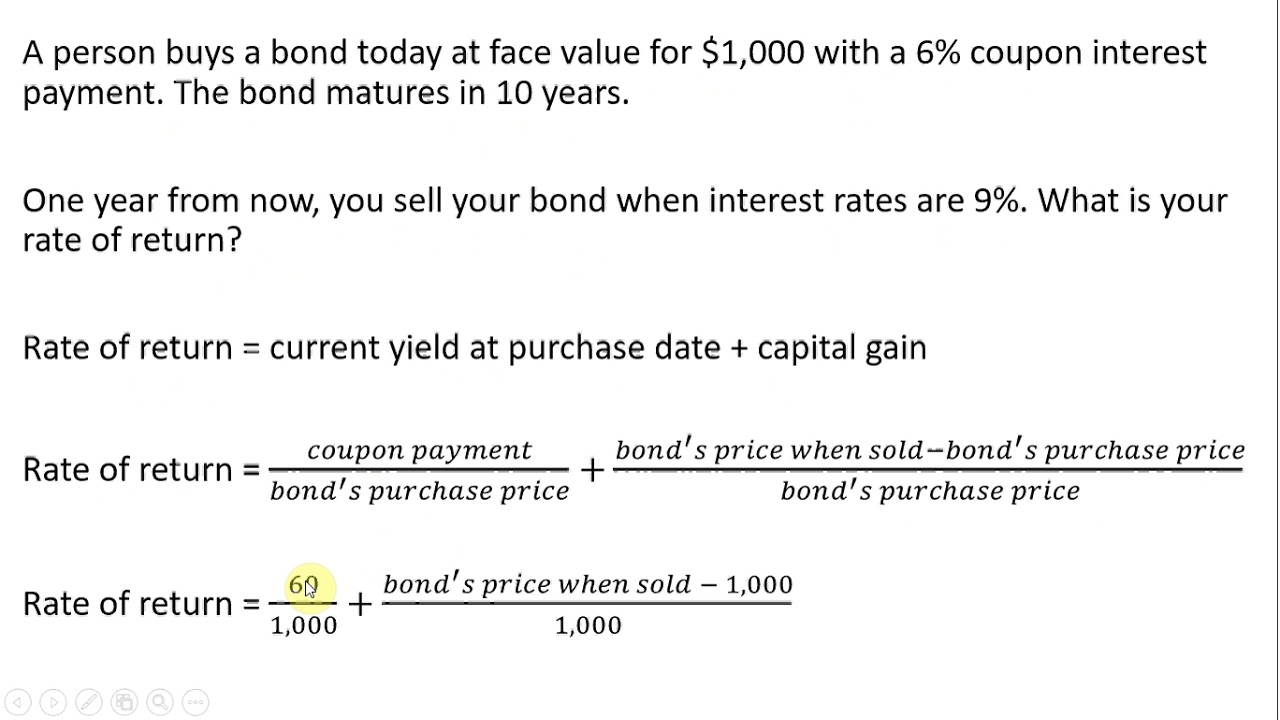

What is current bond yield? - KnowledgeBurrow.com The annual coupons are at a 10% coupon rate ($100) and there are 10 years left until the bond matures. What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula:

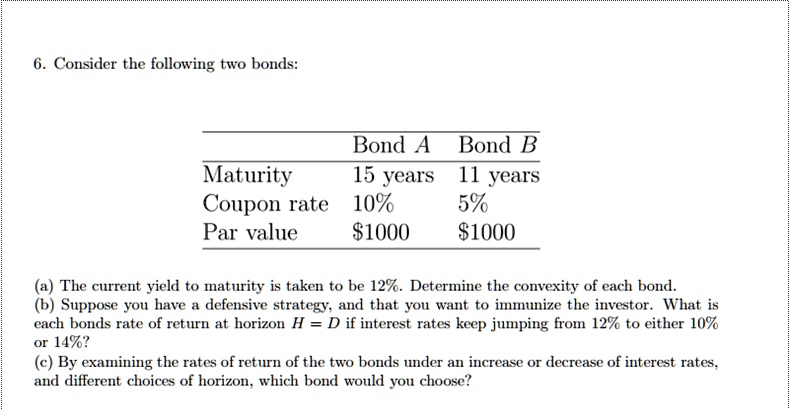

Answered: the following information to answer the… | bartleby Answered: the following information to answer the… | bartleby. Business Finance the following information to answer the questions. Bond A Bond B Face Value 1000 1000 Coupon rate 10% 8% Coupons paid out Semi-annually Quarterly Years to maturity 4 4 Bond price 800 ? Suppose bond A and B have the same YTM. What is the yield to maturity of bond A?

Answered: What is the coupon rate for a bond with… | bartleby What is the coupon rate for a bond with 3 years until maturity, a price of $1,053.46, and a yield to maturity of 7%? Interest is paid annually.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

What is the after.docx - 1. What is the after-tax return on... What is the after-tax return on an 8% coupon rate bond for an investor in a 25% marginal tax bracket? CORRECT ANSWER: 6% see more. CORRECT ANSWER : 6 % see more. 2. A steeply upward-sloping yield curve indicates that: CORRECT ANSWER: Interest rates are expected to rise in the future.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond,...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from ...

Post a Comment for "40 what is bond coupon rate"